Level up your business with Cash Advances

Need a little extra to supercharge your business? We've partnered with YouLend to offer flexible funding solutions based on your trading history

Quick & Easy Application

You can apply in just a few minutes through the Lopay app. Simply go to the ‘My Account’ section to begin. No forms to print or long processes to deal with.

Fast Access to Funds

You can receive funding within a few days, without complex negotiations. Pre-approved offers are based on your business activity, so you can find an option that fits your needs.

Flexible & Automatic Repayments

Repay through a simple percentage of your weekly earnings, so payments adjust with how your business is doing. And if you need additional funds later, you can request a top-up directly in the app.

Give your business a boost

The possibilities are endless when you apply in just three steps through the Lopay app, enabling you to receive funding instantaneously.

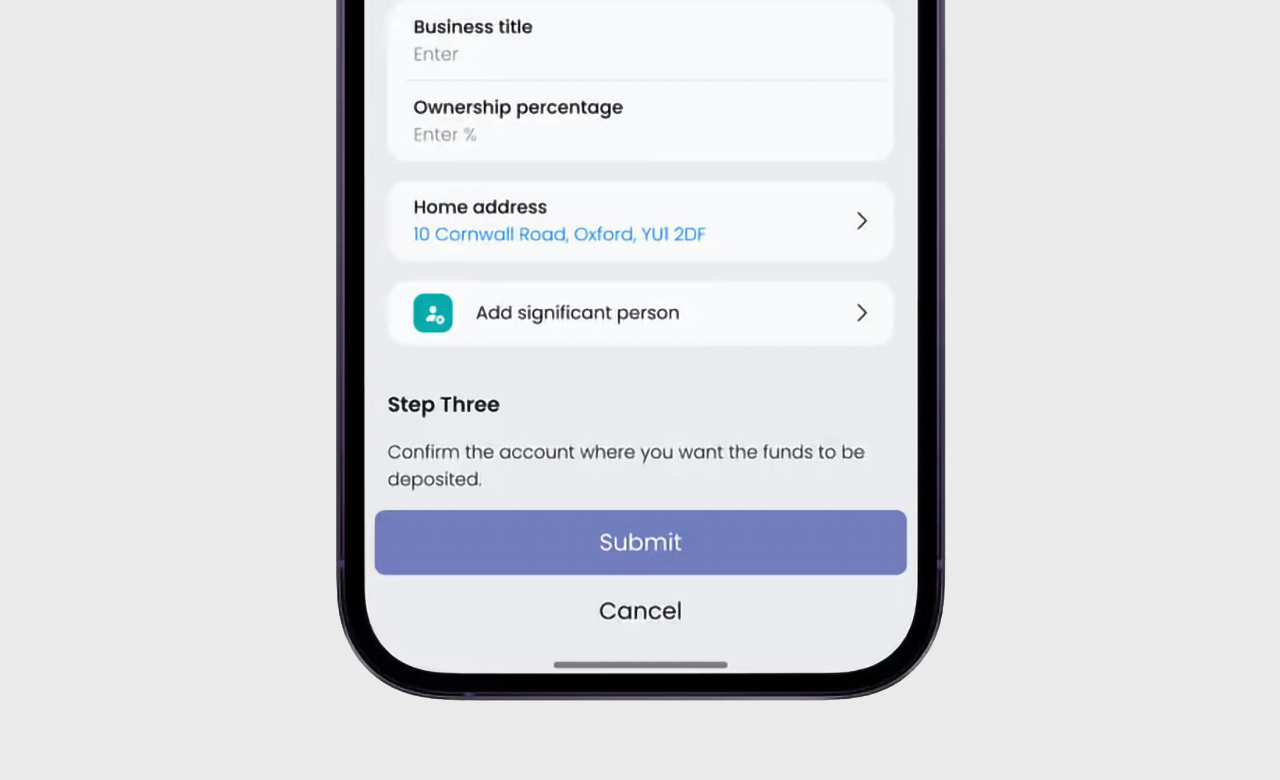

Apply in 3 easy steps

Once you have been trading with us for a few months and you are eligible, you’ll be able to apply for a Cash Advance. Here’s how in 3 quick steps.

Frequently asked

questions

For more detailed information, please read our Cash Advance support article here.

Lopay works with YouLend Limited to offer cash advances to merchants using Lopay.

YouLend Limited is authorised and regulated by the Financial Conduct Authority (FCA) as a Payment Institution to provide payment services within the UK under firm reference number 947287. Find out more about YouLend here.

You will be notified via email and within the Lopay app when a cash advance offer is available to you. A minimum of 3 months of trading history is required.

The longer you've been trading through Lopay and the higher your monthly revenue, the larger your offers will be. Typically offers will be up to two times your monthly revenue.

As an example, if you have an ecommerce business that has sales of £10,000 each month on average, and you started your business 12 months ago, you could be eligible for £15,000 in funding with a fixed fee of £1,500 and repayment of 20% of your daily sales.

With a cash advance you won't pay interest. You will only be charged a single fixed fee, so you know up front exactly what you will repay. All terms will be clearly set out in your Lopay app and you choose the size of the advance that suits you.

If you receive a cash advance it will be repaid over an agreed period via deductions from the payments you take through Lopay. However, if you're earnings are lower than expected and deductions from your Lopay transactions are insufficient, YouLend reserve the right to take repayments direct from your bank.

Ready to give Lopay a try?

Lopay is free to download, with no contracts, commitments or monthly fees when you sign up. Take a look around the app to see what Lopay can do for your business!